How Long Does It Take to Be Named Executor of an Estate in Colorado?

Being named an executor of an estate in Colorado is an important legal responsibility that involves managing the decedent’s assets, paying off debts, and distributing property according to the will or state law. But how long does it take for an individual to officially assume this role? Let’s break down the timeline and the steps involved in the process.

1. Filing the Probate Petition

The first step to being named executor is filing a petition for probate with the appropriate Colorado probate court. The timeline for filing depends on how quickly the heirs or interested parties act after the death of the decedent. In Colorado, probate is typically initiated in the county where the deceased resided at the time of death.

- Timing: The petition should generally be filed as soon as possible after the death—often within 30 days.

- Required Documents: You will need the original will (if one exists), the death certificate, and completed court forms, such as the JDF 920 (Application for Informal Probate) or JDF 915 (Petition for Formal Probate).

2. Court Review and Appointment

Once the petition is filed, the court reviews the documentation to ensure everything is in order. If the will names an executor, the court usually honors this choice unless there are objections or eligibility issues.

- Uncontested Appointments: If no one contests the will or the appointment of the executor, the process is relatively quick.

- Contested Appointments: If there are disputes among heirs or other issues, such as questioning the validity of the will, the process can take much longer.

- Timeline:

- Informal Probate: If the process is uncontested, an executor can be appointed within a few weeks of filing.

- Formal Probate: If the process involves hearings or disputes, it can take several months or longer for an executor to be officially appointed.

3. Issuance of Letters Testamentary or Letters of Administration

Once the court approves the appointment, it issues Letters Testamentary (if there is a will) or Letters of Administration (if there is no will). These documents grant the executor the legal authority to act on behalf of the estate.

- Timeline: Letters are typically issued within a few days to weeks after the court’s decision, provided all paperwork is in order and there are no pending disputes.

Factors That Can Delay Appointment

Several factors can influence how quickly someone is named executor in Colorado:

- Incomplete or Incorrect Paperwork: Missing documents or errors in the filing can lead to delays.

- Contested Wills: If heirs dispute the validity of the will or the choice of executor, the process can take significantly longer.

- No Will Present: In cases of intestacy (no will), the court must identify and appoint an administrator, which can extend the timeline.

- Court Backlog: Busy court schedules can delay the review and approval process.

- Heir Notifications: Colorado law requires that all interested parties be notified of the probate filing, which can take time, especially if heirs are hard to locate.

Tips to Expedite the Process

- Ensure Complete Documentation: Double-check that all forms, the will, and the death certificate are accurate and complete before filing.

- Hire an Attorney: Working with a probate attorney can help navigate the legal process efficiently.

- Communicate with Heirs: Proactively address potential disputes or concerns with heirs to minimize objections during the process.

- Choose Informal Probate: If applicable, informal probate can significantly reduce the timeline compared to formal probate.

Other Considerations

In Colorado, the timeline for being named executor of an estate varies based on the complexity of the case, the existence of a valid will, and whether disputes arise. In the best-case scenario, an executor can be officially appointed within a few weeks. However, more complex cases can take several months or longer.

If you’re navigating the probate process, consider consulting with an experienced probate attorney to ensure a smooth and timely appointment.

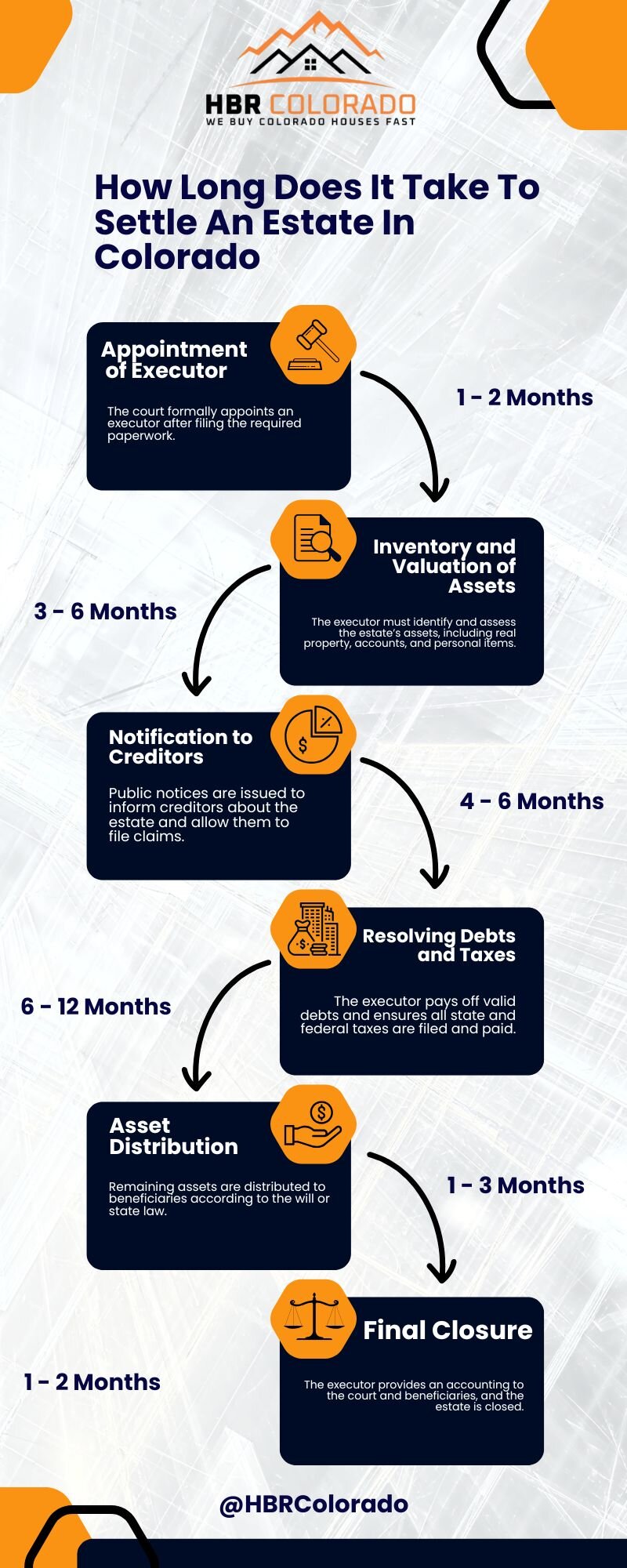

How Long Does It Take To Settle An Estate In Colorado?

| Step | Description | Estimated Time |

|---|---|---|

| Appointment of Executor | The court formally appoints an executor after filing the required paperwork. | 1-2 months |

| Inventory and Valuation of Assets | The executor must identify and assess the estate’s assets, including real property, accounts, and personal items. | 3-6 months |

| Notification to Creditors | Public notices are issued to inform creditors about the estate and allow them to file claims. | 4-6 months |

| Resolving Debts and Taxes | The executor pays off valid debts and ensures all state and federal taxes are filed and paid. | 6-12 months |

| Asset Distribution | Remaining assets are distributed to beneficiaries according to the will or state law. | 1-3 months |

| Final Closure | The executor provides an accounting to the court and beneficiaries, and the estate is closed. | 1-2 months |

The time it takes to settle an estate in Colorado can vary significantly but typically ranges from 6 to 18 months. Here are some key points regarding the timeline:

- Minimum duration: Both informal and formal probates in Colorado must remain open with the court for at least 6 months.

- Average timeline: On average, estates in Colorado are administered in 9 to 18 months.

- Factors affecting duration:

- Complexity of the estate

- Type of probate process (informal, formal, or small estate)

- The presence of disputes or contests

- Asset valuation and liquidation time

- Creditor claims resolution

- Small estates: For estates with less than $64,000 in probate assets and no real property, the process can be quicker using an affidavit.

- Informal probate: The majority of probates in Colorado are informal and can be completed in as little as 6 months, though they often take longer.

- Formal probate: These cases, involving disputes or complex issues, typically take longer to settle.

- Creditor period: Colorado requires a 4-month creditor claim window, which affects the overall timeline.

- Final steps: The estate can be closed once all assets are transferred, claims are satisfied, and tax returns are filed and paid.

While some estates may be settled relatively quickly, others can take several years, depending on their complexity and any challenges that arise during the process.

How To Handle Being Appointed Executor In Colorado

When appointed as the executor of an estate in Colorado, one important aspect to consider is the timeframe for settling the estate. Executors have various responsibilities and tasks to fulfill during the probate process. In this article, we will explore the timeline for settling an estate in Colorado and provide a step-by-step guide for executors to effectively manage their duties within the designated timeframes.

- Understanding the Probate Process: Before delving into the timeframe, it is crucial to grasp the basic steps involved in the probate process. Probate is the legal procedure that oversees the distribution of a deceased person’s assets and the resolution of their debts. It typically involves validating the will, inventorying assets, paying debts, and distributing remaining assets to beneficiaries.

- Initiating the Probate Process: Upon the death of the decedent, the executor should initiate the probate process in a timely manner. In Colorado, the executor must file the will and necessary documents with the appropriate probate court within ten days after learning of the decedent’s passing.

- Appointment of the Executor: Once the court receives the necessary documents, they will review them and, if everything is in order, appoint the executor. The appointment usually occurs within a few weeks, but the timeline may vary depending on the court’s caseload.

- Inventorying Assets: After being appointed, the executor must inventory the decedent’s assets. Colorado law requires the inventory to be filed with the court within three months from the date of appointment. This inventory includes a detailed list of all the assets, their values, and any relevant supporting documentation.

- Notifying Creditors and Settling Debts: Executors have a responsibility to notify known creditors of the decedent’s death and publish a notice to creditors in a local newspaper. Creditors then have a specific timeframe, usually four months from the date of publication, to submit their claims against the estate. The executor must carefully review and settle valid debts within this timeframe.

- Tax Filings: Depending on the complexity of the estate, the executor may need to file various tax returns, including income tax returns for the decedent and estate tax returns if applicable. It is essential to adhere to the designated tax filing deadlines to avoid penalties or complications.

- Distribution to Beneficiaries: Once debts, taxes, and administrative expenses are paid, the executor can proceed with distributing the remaining assets to the beneficiaries. While there is no specific timeframe outlined by Colorado law, executors should strive to complete the distribution process as promptly as possible, keeping beneficiaries informed along the way.

- Closing the Estate: After fulfilling all obligations and distributing assets, the executor must prepare a final accounting and report to the court. Once the court approves the final accounting, the estate can be officially closed. The timeline for closing the estate may vary depending on the court’s procedures and workload.

- Seeking Professional Guidance: Executors often face complex legal and financial matters throughout the probate process. Executors should seek the assistance of an experienced probate attorney to navigate the legal requirements, meet deadlines, and ensure a smooth and efficient settlement of the estate.

As an executor in Colorado, understanding the timeframe for settling an estate is crucial for fulfilling your responsibilities effectively. While the probate process may vary depending on the complexity of the estate and the court’s procedures, adhering to the designated timelines for tasks such as filing documents, inventorying assets, settling debts, and distributing assets is essential. Seeking guidance from a probate attorney can provide valuable support throughout the process and help ensure compliance with legal requirements.

When someone passes away in Colorado and leaves behind property and assets, their executor or personal representative is responsible for managing and distributing those assets according to the deceased’s wishes. This can include paying outstanding bills, filing tax returns, and transferring ownership of property.

To become an executor of an estate in Colorado, you will need to be appointed by the probate court. This involves submitting an application and providing documentation, such as the deceased’s will and death certificate. Once appointed, the executor has a fiduciary duty to act in the best interests of the estate and its beneficiaries.

It’s important to note that the probate process can be complex and time-consuming and requires a good understanding of Colorado probate law. As such, many executors choose to work with an experienced probate attorney to help guide them through the process.

Overall, being an executor of an estate in Colorado is an important responsibility, but it can also be overwhelming.

Learn about the timeline for settling an estate in Colorado as an executor. From probate to distribution, understand your legal obligations and deadlines.

Time is of the Essence: Navigating the Timeline for Settling an Estate in Colorado

Losing a loved one is never easy, and the process of settling their estate can be both time-consuming and emotionally draining. If you have been named as the executor of an estate in Colorado, it’s important to understand your responsibilities and obligations to ensure that the process is completed on time.

Definition of an Executor

An executor is someone who has been named in a will as the individual responsible for managing and distributing the assets of the deceased person. This role comes with many responsibilities, including filing paperwork with the court, paying off any debts or taxes owed by the deceased person, and distributing assets to beneficiaries according to the terms outlined in the will.

The Importance of Settling an Estate On Time

Settling an estate can be a lengthy process, but it’s important to do so as quickly as possible. The longer it takes to settle an estate, the more expensive it can become due to ongoing administrative costs.

Additionally, beneficiaries may become frustrated or anxious if they are left waiting for their inheritance. Settling an estate promptly can help provide closure for everyone involved and reduce stress during an already difficult time.

Overview of the Timeline for Settling an Estate in Colorado

In Colorado, there are specific deadlines that must be met when settling an estate. Generally speaking, most estates will take between six months and two years to settle depending on their complexity.

During this time, several steps must be taken including:

– Filing paperwork with the probate court within ten days of learning about the death – Notifying potential creditors

– Publishing notice of death – Paying off any outstanding debts or taxes owed by the deceased person

– Distributing assets according to instructions outlined in the will

While some estates may move more quickly through this process than others, it’s important to understand that settling an estate is a complex and time-consuming process that requires attention to detail and careful coordination with professionals like attorneys and accountants.

Duties Of The Executor

If you have been named as the executor of an estate in Colorado, it’s important to understand your obligations and responsibilities. Settling an estate can be a lengthy process, but doing so promptly can help reduce stress and provide closure for everyone involved. By working closely with professionals like attorneys and accountants, you can ensure that the process moves as smoothly as possible while still meeting all legal requirements.

The Role of the Executor

Responsibilities and Duties of an Executor

When someone passes away, their assets and debts must be managed and distributed according to their wishes. This is where an executor comes in – they are responsible for managing the deceased’s estate.

The executor has several key responsibilities, including identifying all assets and liabilities, notifying beneficiaries and creditors, paying off debts and taxes, distributing assets to beneficiaries, and closing the estate. One of the most important duties of an executor is to locate all of the deceased’s assets.

This can include bank accounts, investments, real estate, personal property (e.g., jewelry or artwork), and any other items that may be included in the estate. The executor must take inventory of these assets and determine their value.

Once all assets have been identified, the executor must also locate any outstanding debts owed by the deceased. This can include mortgages or car loans, credit card debt, medical bills, or any other obligations owed by the deceased at the time of their death.

The executor will then prioritize these debts according to state law before paying them off using funds from the estate. After all necessary payments have been made to creditors and taxes have been paid on behalf of the deceased person’s estate; then it is time for distribution of remaining assets to beneficiaries named in a will or lawfully entitled if there isn’t a will.

Legal Obligations to Beneficiaries and Creditors

As legal representatives for a decedent’s estate; Executors are obligated by law to protect both creditors’ rights as well as property rights belonging to heirs/ beneficiaries mentioned in a will. As such he/she must develop good working relationships with each party so that trust is established relationally. For example: When selling your Colorado house – The executor must first pay any outstanding mortgages before transferring ownership to heirs or beneficiaries.

The Executor owes a fiduciary duty to the beneficiaries of the estate, which includes acting in their best interests at all times. They must keep accurate records and provide regular updates on the status of the estate, including any changes that may impact beneficiaries.

The executor plays an important role in resolving any disputes that may arise between beneficiaries and is responsible for ensuring that all parties receive their fair share of the estate. The executor also has a legal obligation to protect confidential information related to the deceased person’s finances and affairs.

In addition, if there are minor children involved or some incapable adults who are incapable of managing their own affairs then it is the responsibility of the executor to take care that they receive what they are entitled to from the deceased person’s assets. This may require setting up trusts or other legal arrangements to ensure these individuals’ interests are protected.

Overall, being an executor is a complex and demanding role requiring attention to detail. Executors need to be familiar with state laws governing probate administration and have a good understanding of how assets should be managed and distributed under those laws.

Probate Process in Colorado

Understanding Probate

Probate is the legal process of transferring a deceased person’s assets to their heirs or beneficiaries. It ensures that the distribution of assets is conducted according to the deceased’s wishes as outlined in their will or, in the absence of a will, according to state law. This process is essential in Colorado, as all wills and intestate estates (those without a valid will) must be probated to legally transfer assets.

Overview of the Probate Process

In Colorado, the probate process begins with filing an application for probate with the court. Once the court approves the application, an executor is appointed to manage and distribute the estate. The executor must then notify all creditors and beneficiaries of the estate of their rights and responsibilities. This includes publishing a notice to unknown creditors in a local newspaper. The executor must also create an inventory of all assets and debts, which is filed with the court.

By following these steps, the probate process ensures that all parties involved are aware of their entitlements and obligations, maintaining transparency and fairness in the distribution of the deceased’s estate.

Timeline for Probate Process

The timeline for completing the probate process varies depending on several factors, including whether there are disputes among beneficiaries or creditors, whether there are complex legal issues to resolve, and whether there are any challenges to the will. In Colorado, a simplified probate process is available for estates valued at less than $66,000.

In this case, a sworn statement can be filed with the court instead of going through a formal probate process. This can significantly reduce the time it takes to settle an estate.

For larger estates that require formal probate proceedings, however, it can take between six months and two years or more to complete the process. The length of time it takes depends on many factors such as locating all heirs or potential heirs if no will exists; identifying all assets; paying any debts owed by the decedent; tax reporting obligations; determining who receives what under terms of will or state law if no will exists; any potential litigation that may arise related to the enforceability of will etc.

Criteria for Small Estates

Small estates in Colorado are defined as those with assets less than a specific threshold and no real property, such as a house or condo. When an estate meets these criteria, handling it becomes considerably simpler.

Simplified Process

In these cases, rather than opening a formal probate action through the court, you can file a sworn statement. This affidavit process allows the personal representative, or executor, to swear they are entitled to collect the assets. They also commit to distributing the assets according to the will.

- Affidavit Use: This sworn statement takes the place of a formal probate process, significantly reducing the time it takes to settle an estate.

For larger estates that require formal probate proceedings, however, it can take between six months and two years or more to complete the process. This distinction underscores the efficiency and appeal of the simplified process for eligible small estates.

Factors that Can Impact Timeline

Several factors can impact how long it takes to settle an estate in Colorado. One factor is whether there are disputes among beneficiaries or creditors over the distribution of assets.

If there are disputes, it can take longer to resolve them and distribute the estate. Another factor is the complexity of the estate.

If there are many assets to be managed or if there are complex legal issues involved, it can take longer to settle the estate. Additionally, if there are challenges to the will, such as claims that it was improperly executed or that the decedent lacked testamentary capacity, this can also add time to the probate process.

Delays may arise due to issues related to taxes or creditors. The executor must satisfy any outstanding debts owed by the decedent before distributing remaining assets, and ensure all tax returns are filed and tax obligations paid before beneficiaries receive their inheritance.

While Colorado offers a simplified probate process for small estates that speeds up settling an estate; larger estates generally require formal probate proceedings with a timeline varying from six months to two years. The timeline depends on several factors such as the complexity of the estate; disputes among beneficiaries/creditors; litigation regarding the enforceability of wills etc. It is important for executors and beneficiaries alike in Colorado to seek professional legal advice on settling estates promptly while fulfilling all legal obligations under state law.

What is Informal Probate for Uncontested Estates in Colorado?

Informal probate in Colorado is a streamlined process used when dealing with uncontested estates—situations where the will is not expected to be challenged. This type of probate is simpler because the court plays a minimal role, focusing primarily on ensuring the execution of the will’s instructions.

Key Features of Informal Probate:

- Limited Court Involvement: The court mainly must oversee that the will is properly executed according to its terms.

- Minimal Disputes: This process is ideal when there is a valid will and no anticipated disputes among heirs or beneficiaries.

- Duration: Although the estate may take longer to fully administer, the probate must remain open with the court for at least six months.

This process allows for a more efficient transfer of assets, reducing the time, costs, and complications typically associated with probate.

Timeframe for Settling an Estate in Colorado

When someone passes away, their estate must go through a legal process known as probate. During this time, the executor of the estate is responsible for managing the deceased person’s assets and debts. In Colorado, there are specific deadlines that must be met when settling an estate.

Statutory deadlines for filing documents

One important deadline is related to filing documents with the court. The executor of an estate must file a petition to open probate within ten days of the death of the decedent. This document notifies the court that an executor has been appointed and begins the probate process.

In addition to this initial filing, other documents must be filed promptly. For example, within 90 days of being appointed as executor, you must file an inventory with the court that lists all of the assets and debts of the estate.

If you fail to meet these deadlines, it could result in additional fees or penalties. It’s important to work closely with an experienced probate attorney who can help ensure all necessary documents are filed on time.

Timeline for paying debts and taxes

Another important aspect of settling an estate in Colorado is paying off any outstanding debts and taxes owed by the deceased person. Generally speaking, creditors have nine months from the date of death to file a claim against the estate for any money owed. The executor is responsible for reviewing these claims and paying them off using funds from the estate.

Understanding the Probate Process for Debt Payment

The probate process in Colorado involves several key steps to ensure debts are handled appropriately. Here’s how it typically unfolds:

- Notification of Creditors: The executor must notify known creditors about the probate process. This is usually done by publishing a notice in a local newspaper, which starts the clock on the nine months for creditors to submit claims.

- Review and Validation of Claims: Once claims are submitted, the executor evaluates each one to determine its validity. This step may involve verifying documentation and ensuring the claim is justifiable.

- Priority of Payments: If there aren’t enough assets to cover all debts owed, there is a specific priority list that determines which creditors get paid first. This list often prioritizes secured debts and administrative expenses over unsecured debts.

- Resolution of Disputes: In cases where a claim is disputed, the executor may need to negotiate with the creditor or seek court intervention to resolve the issue.

Addressing Taxes During Probate

In addition to debt payments, taxes also need to be addressed during probate. This includes both federal and state income tax returns for any income earned by the deceased person before their passing. The executor may also need to file a federal estate tax return if the value of the estate is above a certain threshold.

By meticulously following these steps, the executor ensures that all debts are settled under Colorado laws, ultimately facilitating a smoother probate process.

Distribution of assets to beneficiaries

Once all debts and taxes have been paid, the remaining assets can be distributed to beneficiaries according to the terms of the will. However, there may be additional legal requirements that impact this process.

For example, if someone contests the validity of the will or there are disputes among beneficiaries, it could delay the distribution of assets. Additionally, if any assets require appraisal or sale before they can be distributed, it could also impact the timeline.

Ultimately, it’s up to the executor and their legal team to ensure that all legal requirements are met and assets are distributed appropriately. It’s a complex process but with careful planning and attention to deadlines, settling an estate in Colorado can be done promptly.

What Role do Attorneys and Accountants Play in the Probate Process?

Attorneys and accountants play crucial roles in the probate process, each contributing their specialized expertise to ensure the smooth administration of an estate:

Probate Attorneys:

- Guide executors through the legal process, including applying for a grant of probate and filing necessary court documents.

- Assist in locating and valuing assets, settling debts and taxes, and communicating with beneficiaries.

- Draft essential estate planning documents like wills, trusts, and powers of attorney.

- Represent clients in case of disputes, offering mediation or litigation services if necessary.

- Ensure compliance with state laws and court procedures throughout the probate process.

Probate Accountants:

- Oversee the financial aspects of estate administration, including estate valuation, tax filings, and debt settlement.

- Provide advice on estate and inheritance tax matters to minimize tax liabilities.

- Prepare detailed financial reports and coordinate with the probate court on financial matters.

- Assist in preventing probate fraud by ensuring transparent financial dealings.

- Aid in the fair distribution of assets to beneficiaries, taking into account specific bequests in the will.

Additional Probate Services in Colorado:

- Checklist for Probate: A comprehensive guide to each step in the Colorado probate process, ensuring no detail is overlooked.

- Real Estate Sales During Probate: Expertise in navigating the complexities of selling real estate within the probate framework, ensuring compliance and maximizing asset value.

- Estate Settlement: Detailed assistance in settling an estate, including the distribution of assets and resolution of any outstanding legal issues.

- Letters of Administration: Guidance in obtaining necessary legal documents for administrating estates, critical for moving the probate process forward.

- Out-of-State Probate: Specialized services for managing estates that involve properties or heirs outside Colorado, ensuring all legal requirements are met across jurisdictions.

- Debt and Creditor Management: Strategies for effectively managing and paying off debts, protecting the estate’s value while complying with legal obligations.

- Personal Representative Services: Clarification of duties and powers, providing support to executors in fulfilling their roles efficiently.

- Trust Settlement: Professional handling of trust-related matters, ensuring that all trust terms are honored and properly executed.

- Asset Valuation and Liquidation: Expert evaluation and liquidation of assets, securing fair market value and facilitating their distribution to beneficiaries.

- Legal Representation: The critical role of probate lawyers, ensuring that all legal aspects are managed with precision and expertise.

Both professionals and services work in concert to ensure the estate is properly managed, legal requirements are met, and financial matters are handled accurately and efficiently throughout the probate process in Colorado. legal requirements are met, and financial matters are handled accurately and efficiently throughout the probate process.

Factors that Can Affect the Timeline

When it comes to settling an estate in Colorado, there are several factors that can affect the timeline. The complexity of the estate, disputes among beneficiaries or creditors, and legal challenges to the will are all potential roadblocks that can extend the amount of time it takes to settle an estate.

The Complexity of the Estate

One factor that can significantly impact how long it takes to settle an estate is its complexity. If there are a large number of assets to be distributed, multiple heirs or beneficiaries, or complex financial holdings (such as business interests), it may take longer for the executor to properly value and distribute these assets. Additionally, if there are any outstanding debts or liens against the estate, these must be resolved before assets can be distributed.

In some cases, it may be necessary for the executor to hire outside professionals (such as appraisers or accountants) to help value and distribute assets. This can add additional time and expense to settling the estate.

Disputes Among Beneficiaries or Creditors

Another factor that can prolong settling an estate is disputes among beneficiaries or creditors. If there is disagreement among heirs about how assets should be distributed, this must be resolved before any distribution can take place. Similarly, if there are any outstanding claims by creditors against the estate (such as unpaid debts), these must also be resolved before assets can be distributed.

These disputes may need to go through legal proceedings in order to reach a resolution. This can add significant time and cost to settling the estate.

Legal Challenges to Will

A legal challenge to a will is another factor that can extend how long it takes for an executor to settle an estate in Colorado. If someone contests a will (either because they believe it was not properly executed or because they believe they were unfairly excluded from receiving assets), this can throw a wrench in the process.

Legal challenges to wills can take a long time to resolve and may require court proceedings. In some cases, it may be necessary for the executor to hire legal representation to defend the will.

Patience is Key

Settling an estate in Colorado can take longer than expected due to factors like the complexity of the estate, disputes among beneficiaries or creditors, and legal challenges to the will. Executors should be prepared for these potential roadblocks and understand that patience may be required. Seeking guidance from a qualified attorney can help ensure that all legal requirements are met and that settling the estate is done as efficiently as possible.

How to Sell Real Estate During Probate in Colorado

Selling real estate during probate in Colorado might seem complicated, but it can be navigated smoothly with the right approach. Here’s a step-by-step guide to help you through the process:

Understand the Probate Process

Before jumping into the property sale, it’s essential to comprehend the probate process. In Colorado, probate is a legal procedure that involves validating a deceased person’s will and overseeing the distribution of their assets. If you are an executor or personal representative, you’ll be responsible for managing this process.

Obtain Court Approval

One of the key steps in selling probate real estate is obtaining the court’s approval. You’ll need to file a petition to sell the property, providing a clear reason for the sale. This ensures transparency and protects the interests of the heirs and creditors. Once granted, you can proceed with the sale.

Appraise the Property

A professional appraisal is often required to determine the fair market value of the property. This helps to set a realistic selling price and ensures that the property is sold at a fair value, which is crucial for maintaining the integrity of the probate process.

Hire a Probate Real Estate Agent

Consider hiring a real estate agent with probate experience. An agent familiar with the nuances of Colorado probate can guide you through legalities and marketing strategies, helping the property to reach potential buyers.

Market the Property

Effective marketing is critical in attracting buyers. Use a blend of online listings, open houses, and social media platforms like Zillow, Trulia, and Realtor.com. Highlight the key features and any unique aspects of the property to make it stand out in the market.

Accept Offers and Close the Sale

Once you receive offers, evaluate them carefully. It’s important to consider not just the price but also the terms of each offer. After selecting the best offer, you’ll need to return to court for a final approval before closing the sale.

Distribute the Proceeds

After the sale closes, any proceeds will go towards settling debts, taxes, and distribution to heirs according to the will or state law if no will exists. Ensure this final step is handled with care to prevent any future legal complications.

By following these steps, you can successfully sell real estate during probate in Colorado, ensuring a smooth transition for all parties involved.

Summary of Key Points on How long does an executor have to settle an estate in Colorado

The executor of an estate in Colorado must complete the probate process within one year after the appointment. This timeline can be extended for up to six months with court approval. The executor has many responsibilities during this time, including paying debts and taxes, distributing assets to beneficiaries, and fulfilling legal obligations to all parties involved.

The probate process in Colorado includes several steps that must be followed carefully to ensure that everything is completed on time and according to legal requirements. This process involves filing various documents with the court, notifying creditors and beneficiaries of the estate, and resolving disputes as they arise.

It’s important for executors to understand the specific deadlines involved in settling an estate in Colorado so that they can fulfill their duties properly. They should also seek advice from a qualified attorney who specializes in probate law if they have any questions or concerns about their responsibilities.

Importance of Seeking Legal Advice from a Qualified Attorney

Given the complexity of settling an estate in Colorado and the potential legal liabilities involved, it’s highly recommended that executors seek advice from a qualified attorney who specializes in probate law. An attorney can help executors navigate through the entire probate process, from filing documents with the court to distributing assets to beneficiaries.

An experienced attorney can also provide guidance on how to deal with disputes among beneficiaries or creditors, as well as other issues that may arise during settlement. By working with an attorney throughout this process, executors can ensure that they fulfill their duties properly and avoid any unnecessary legal problems.

Final Thoughts on Settling Estates Promptly

Settling an estate is a complex process that requires careful planning and attention to detail. While there are specific timelines involved for completing this process in Colorado, it’s important for executors to focus on fulfilling their duties properly and efficiently.

By seeking advice from a qualified attorney, executors can ensure that they meet all legal requirements while also protecting themselves from any potential legal liabilities. With the right guidance and support, executors can settle estates promptly and fulfill their obligations to all parties involved.